Government mail service may be affected by the Canada Post labour disruption. See how to send and receive government mail during this time.

Eligibility

The reimbursement form on this page is for people who:

- were issued an Immediate Roadside Sanction (IRS) by the Alberta Sheriff Highway Patrol

- received notice of the cancellation of the IRS by way of a SafeRoads Alberta Review Decision

Other police agencies

The Alberta Sheriff Highway Patrol does not reimburse for IRS cancellations issued by another police agency.

Reimbursement amount

You may be reimbursed for tow and vehicle storage costs related to a cancelled Immediate Roadside Sanction. This includes all of the costs of the vehicle's:

- seizure

- removal

- transportation

- storage

Section 8 of the SafeRoads Alberta Regulation limits reimbursement costs to up to 48 hours after receiving the cancellation notice, or to the expiry of the seizure period (whichever is less).

How to apply for reimbursement

Use the online form on this page for any of these 3 circumstances:

- an Alberta sheriff issued you an IRS – and you are the recipient of a SafeRoads Alberta Review Decision cancelling the IRS and vehicle seizure

- you are the registered owner of a seized vehicle from a cancelled IRS issued by an Alberta sheriff

- you are the legal counsel or agent making an application on behalf of someone in either of the above circumstances

Step 1. Gather your documents

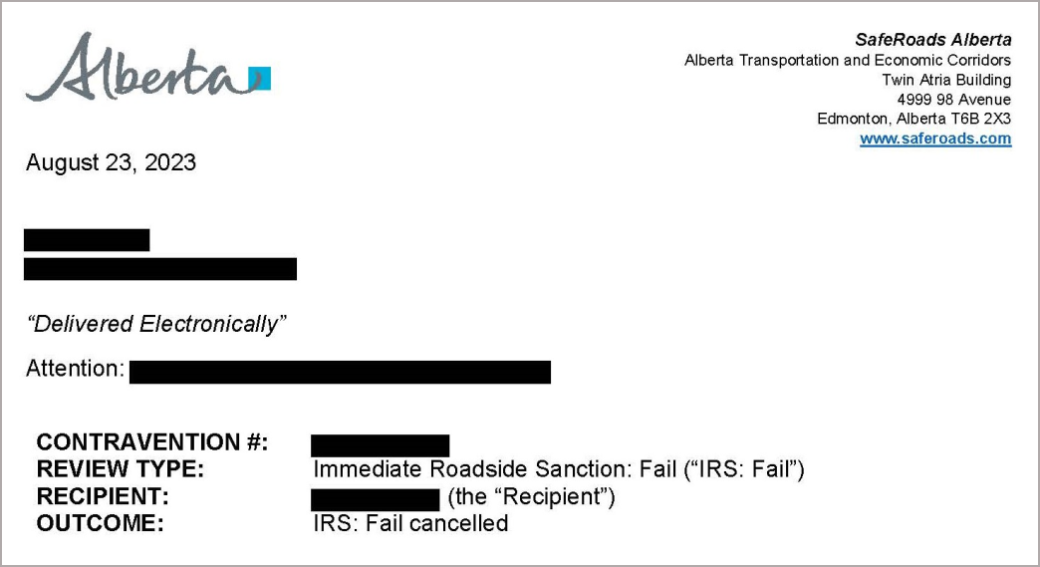

Example of a SafeRoads Alberta Review Decision:

The following documents must be scanned or clearly photographed and uploaded with your application for reimbursement:

- SafeRoads Alberta Review Decision letter reflecting cancellation of the IRS

- towing company invoice or bill with proof of payment

- proof of ownership of the seized vehicle

- letter of consent – required for an agent or legal counsel applying on behalf of the IRS recipient or vehicle owner

- completed application for electronic payment and a picture, scan or PDF of a void cheque – required for reimbursement by way of electronic funds transfer (EFT)