See event listings and more articles in this edition of Agri-News: May 21, 2024 issue

“Canola producers, particularly those with canola in storage, follow cash prices. However, not all canola producers track basis, the difference between the cash price and the futures price,” says Neil Blue, provincial crops market analyst with the Alberta government. “Following basis can give clues to what is happening in the market and provide pricing opportunity.”

The basis is found by subtracting the futures price from a cash price. For example, near mid-May, one Alberta canola buyer’s bid for July delivery was $650/tonne. At that time, July canola futures was at $667/tonne. The cash price of $650 minus the futures price of $667 equals a minus $17/tonne July delivery basis. This is sometimes referred to as an “under” basis, or $17 under the July futures. At the same time, another Alberta canola buyer had a bid of $657/tonne for July delivery canola. The basis of that buyer was $657 minus the July futures of $667, or minus $10/tonne.

“In this example, both canola buyers are pricing with the July futures, but there is a significant difference in their bids for July delivery due to their individual basis levels,” explains Blue. “A decision for a canola seller of which buyer to contract a sale with may depend on delivery costs, grading experience with buyers, contract differences and personal relationships.

“Buyers set their basis level according to how aggressively they need to attract delivery commitments from producers, strengthening their basis relative to the futures price when they need more product, and weakening their basis when they are more comfortable with their product needs being met for a given delivery period.”

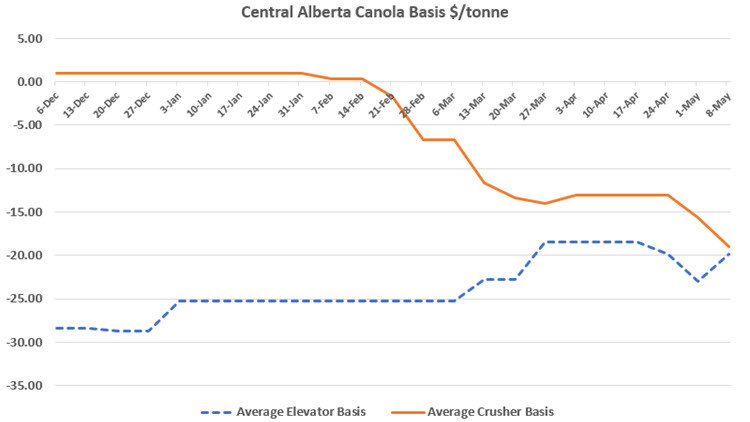

Figure 1 is a 6-month chart of average elevator basis levels in Central Alberta compared to average crusher basis levels for July 2024 delivery canola.

Figure 1. Central Alberta canola basis $/tonne

For most of the winter the average crusher basis level was relatively strong compared to the weaker average elevator basis levels. These relative basis levels were reflective of demand. Canadian canola exports during this crop year have been relatively low while Canadian crusher volume is on pace to set a record high.

As the crop year progressed to early May, there has been increased interest in canola exports as reflected in the improving elevator basis levels. Meanwhile, crusher basis levels have weakened, indicating that, on average, the crushers are increasingly comfortable with their contracted levels with producers.

“Note that short-term ‘specials’, or temporary strengthening of the basis to attract contracting by producers, are not reflected in the chart. Also, sometimes elevators will sell canola to crushers, so elevator buying may not reflect 100% export business,” says Blue.

“Most buyers offer the ability to just contract the basis portion of price. Doing so when basis levels are considered to be strong can be good strategy. Stronger basis levels often are offered when futures prices are relatively low as a buyer tries to encourage producers to contract deliveries. While a producer may hold unpriced canola in storage during the winter market doldrums, expecting futures prices to improve on growing season price volatility, that can be a good time to just lock in the basis with a buyer of choice.”

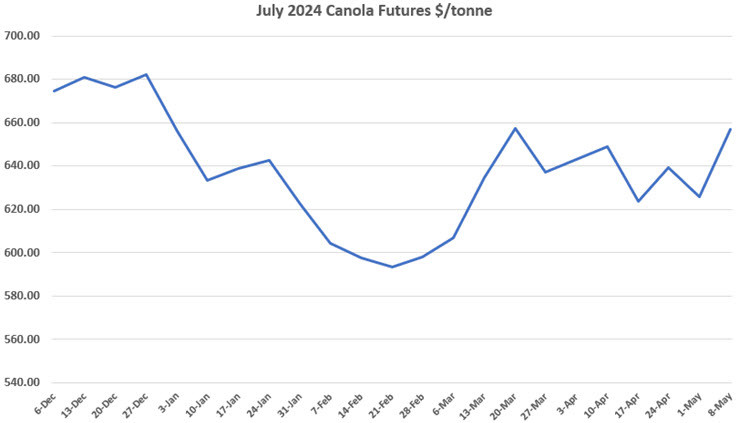

If and when the futures market does rally, which happened this spring, buyers tend to weaken their basis levels. Meanwhile, a producer who has locked in the stronger basis earlier, has the potential to take full advantage of the higher futures price to complete their deferred delivery contract.

Figure 2. July 2024 canola futures $/tonne

The bottom line, says Blue, is following basis levels can be successfully used to capture a better price from the market or at least provide information on market conditions.

For more information, see:

Contact

Connect with Neil Blue for more information:

Phone: 780-422-4053

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news